Governance

"As Chairman of the Corporate Governance, Nominations and Risk Committee and Senior Independent Director my goal is to provide independent oversight and to ensure that the Company has the right corporate governance in place to meet the key strategic objectives of the Group and address the challenges of the energy transition.”

David Mullen

Chairman of the Corporate Governance, Nominations and Risk Committee

At Subsea7, corporate governance goes beyond pure compliance. We believe that high-quality governance creates long-term value for our shareholders, employees, creditors and other stakeholders, and builds long-term, trusting relationships.

We run our business for the benefit of all stakeholders and reflect the high standards they have come to expect from us. As a company incorporated in Luxembourg and quoted on the Oslo Børs, Subsea 7 S.A. is subject to a number of laws and regulations with respect to governance, and is committed to achieving the highest Corporate Governance standards at all times. The term "Company" refers to Subsea 7 S.A. and the term “Group” refers to Subsea 7 S.A. and its subsidiaries.

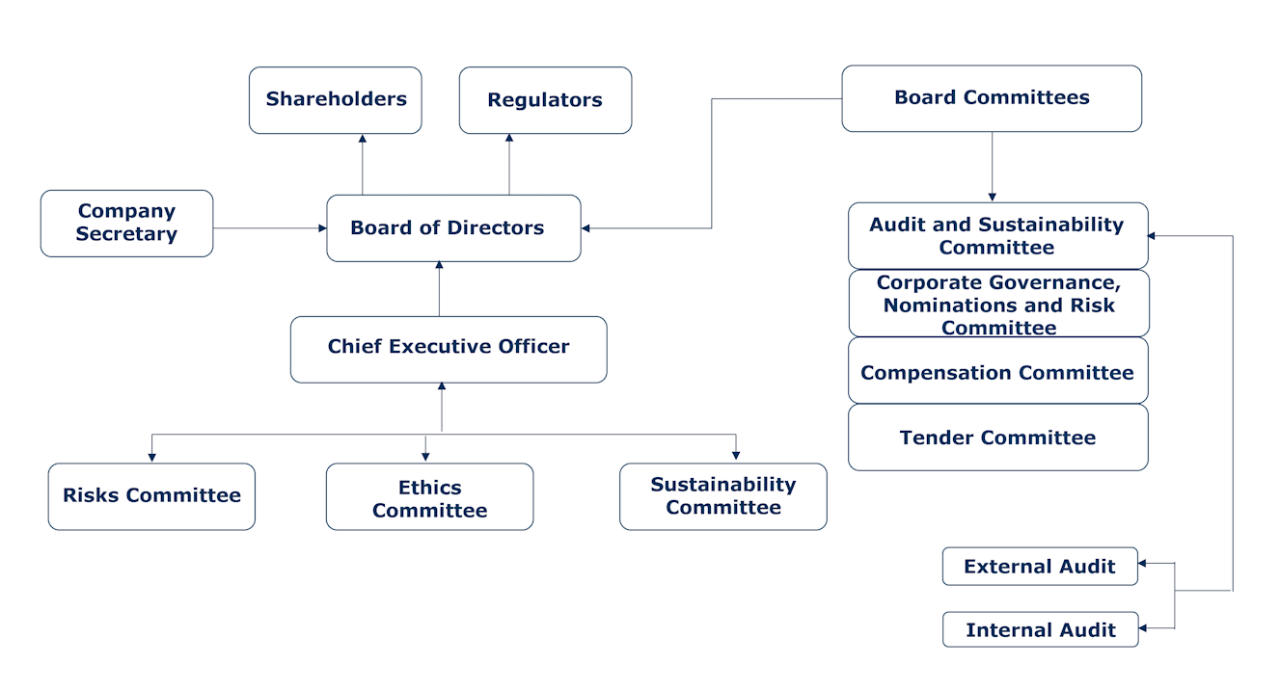

Governance Framework

The Subsea 7 S.A. Board of Directors (the “Board”) has overall responsibility for the management of the Group and meets regularly. Important matters are delegated to a number of Board Committees, helping the Board to effectively fulfil the diverse range of tasks and responsibilities that come with running a global company.

Board of Directors

With overall responsibility for the management of the Group, the Board delegates the daily management and operations of the Group to the CEO. The Board appoints the CEO, who is supported by the other members of the Executive Management Team. The Board maintains high standards of governance throughout the Group. The Board of Directors page details the Group's assessment on the independence of its current directors, together with details of membership of the various Board Committees.

The Board is the principal decision-making forum of the Group and exercises overall control of the Group's affairs. The Board is responsible for the Group's strategy, the approval of financial statements, acquisitions and disposals, treasury and risk management policies and appointment and removal of Directors and Officers.

The main responsibilities of the Board are:

- Setting the values used to guide the affairs of the Group. This includes the Group’s commitment to achieving its health and safety vision and the Group’s adherence to the highest ethical standards in all of its operations worldwide.

- Integrating environmental improvement into business plans and strategies, and seeking to embed sustainability into the Group’s business processes.

- Overseeing the Group’s compliance with its statutory and regulatory obligations and ensuring that systems and processes are in place to enable these obligations to be met.

- Setting the strategy and targets of the Group.

- Establishing and maintaining an effective corporate structure for the Group.

- Overseeing the Group’s compliance with financial reporting and disclosure obligations.

- Overseeing the risk management of the Group.

- Overseeing Group communications.

- Determining its own composition, subject to the provisions of the Company’s Articles of Incorporation.

- Ensuring the effective corporate governance of the Group.

- Approving the remuneration package for the CEO based upon the recommendation of the Compensation Committee.

- Setting and approving policies.

The Board appoints a Chairman, CEO and Senior Independent Director. The Chairman is responsible for the leadership of the Board, and ensuring its effectiveness and independence from the Group's management. The Chief Executive Officer is responsible for implementing the strategy of the business, within the authorities delegated to him by the Board. The Senior Independent Director is elected from among the Independent Directors and provides a sounding board to the Chairman and serves as an intermediary for the other Directors if necessary.

Board Committees

The Board has established a Corporate Governance, Nominations and Risk Committee, a Compensation Committee, an Audit and Sustainability Committee and a Tender Committee. Each has a charter approved by the Board and has matters delegated to it as appropriate. Committee members ensure that the committees operate in an effective manner.

Board Diversity

The Board has adopted a Board Diversity Policy to ensure that the Board is inclusive and diverse and, as a whole, has the skills, expertise and experience to guide the business and strategy of Subsea7 for the benefit of its shareholders, having regard to the interests of all of its stakeholders.

Articles of Incorporation

Subsea 7 S.A.’s Articles of Incorporation, as amended by Notarial Deed on 8 May 2025